“The main cause of the decline in sales from previous years is the weak development of the overall economy and sluggish growth in our key markets and target industries, especially in the tantalum segment,” said Andreas Meier, CEO.

Another factor placing additional strain on the sales result was the weakness of the U.S. dollar and the Japanese yen, alongside temporary weak metal notations, according to the company.

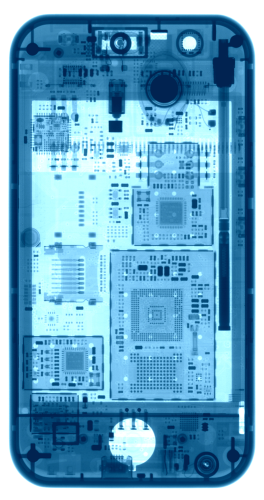

H.C. Starck said it had “very restrained” demand from the electronics industry, especially in the tantalum and niobium powder segment, due to structural changes in consumer electronics and de-stocking activities at key customers. Sales of tantalum components such as sputtering targets also declined due to customer initiatives to reduce existing stock and the weakening of the project business from the chemicals industry.

Tungsten decline

Business in tungsten metal powders was shaped by a sharp decline of the European market and decreases in raw material prices, especially in the first half of 2013. Toward the end of the year, however, this segment experienced a noticeable recovery that brought a positive start to fiscal 2014.

Despite this, H.C. Starck continued to invest in 2013 an eight-figure sum toward targeted expansion of its production facilities to increase the company’s performance. For example, in Germany, tungsten production capacities were expanded while its Taicang site in China was upgraded for production of highly specialized customer-specific components made from technology metals. In addition, the tungsten joint venture in China was largely completed, while first preparatory work was done on-site at another tungsten joint venture in Vietnam.

In 2013 the company continued its R&D activities focused on improving the quality of high-capacity tantalum powders and development of special tungsten carbides for the Asian market. In addition, the company worked with a large medical technology manufacturer on an innovative technology for production of X-ray equipment parts.

Positive 2014

H.C. Starck said that it considered itself to be in a good position for 2014. “We have already proven in the past that we use challenging phases to strengthen our competitive position and gain additional market shares," Meier said. "We are confident that with the continuous realignment of our business to changing customer and market needs we are now more flexible and thus are well positioned for the future.”

The company expects general market conditions to improve in 2014: “We are seeing improvements in the overall sentiment and an end to the reduction of existing stock levels in our key markets. These are good basic conditions when it comes to picking up where earlier successes left off in 2014 and returning to profitable growth as well, thanks to our joint ventures in Asia.”

The operational focus for H.C. Starck in the current fiscal year will be to expand its market position in the tungsten segment. In 2014, the company plans to commission two major tungsten joint ventures, one in China and one in Vietnam. “Thanks to our joint ventures, we are in an outstanding position to leverage Asia’s market potential and use the demand in the tungsten segment for our growth,” Meier said. “Together with our existing tungsten powder production activities in Germany and Canada, this will make us the world’s largest independent tungsten producer.” The products from the two joint ventures will be used as materials in industries such as tool construction, medical technology, the automotive and aviation industry, as well as in the energy sector; in wearing parts for the mining, tunnel and road construction sectors; as metal for alloys, and in catalyst production for the chemicals industry.

Tantalum position

H.C. Starck also plans to strengthen its leading market position in the tantalum segment during the 2014 fiscal year. “We expect this year a rather sideway development in the tantalum capacitor market,” said Meier. “But now that measures to reduce existing stock are coming to an end, we do expect to see demand for our tantalum powders return to higher levels.”

“In line with our obligations as one of the leading manufacturers of tantalum capacitor powders, we will stabilize the tantalum capacitor market together with our key customers and increase our market share: through attractive value for money, innovative products and a secure long-term supply of raw materials.” The company also plans to expand its tantalum product portfolio outside the electronics industry and ramping up sales activities in regions and markets with high growth potential.

The company sees growth opportunities in new and emerging industries such as 3D printing. “For the field of additive manufacturing, our gas atomized metal powders are of great interest because we can adjust them to equipment manufacturers’ requirements, down to the smallest detail,” Meier said.