All hands on deck

Powder metallurgy is on red alert, as the industry scrambles to keep itself afloat following steep declines in powder shipments and a U.S. automotive industry in a state of flux. Throw in a global economic crisis and you have a ‘perfect storm’ threatening the viability of an industry that is still carving a niche within many industrial sectors.

“Certainly in the time I've been in the PM industry, there's not been anything like it,” declared Jonathan Wroe, executive director of the European Powder Metallurgy Association, Shrewsbury, U.K. “It's probably the steepest change we've seen.”

The tale of the tape is alarming, as the financial meltdown, which began in the summer of 2007, has finally pushed the world into a recession. Consequently, it has brought fear and uncertainty through the entire supply chain as job losses mount, factory capacity utilisation levels plummet, and car sales decline significantly. Meanwhile, U.S. iron powder shipments dropped 16% between 2007 and 2008 while some areas of the PM business have seen as much as a 35% sales decline.

These and other economic indicators pointing in the wrong direction have forced industry suppliers into a belt-tightening mode. “[Companies] have reduced work weeks to four days or two weeks per month, reduced 401K contributions, delayed purchases of new equipment, reduced inventories of raw materials, cut unnecessary travel, put through just-in-time manufacturing policies and reduced staff,” observed Jim Trombino, executive director of the Metal Powder Industries Federation (MPIF), Princeton, NJ.

A case in point is CM Furnaces Bloomfield, U.S.A., which is eliminating overtime hours for workers and reducing overall spending, according to Jim Neill, vice president of sales. “We're just maintaining general good practices because the volume has certainly diminished across the board,” Neill said, adding that it also means more work for others. “We're working a hell of a lot longer hours.”

Elnik Systems, Cedar Grove, NJ saw a business downturn coming as far back as mid-2008, and it began taking measures to brace for impact. Claus Joens, president, said the company set forth to tackle 2009 with only a 60% output compared to 2008. “We worked off some of our backlog in orders, and, therefore, the remainder of 2008 was good.”

In Europe, the situation is no different, industry members say, as companies implement similar measures to keep their heads above water. “A lot of companies have been working one, two, three days a week, reducing their capacity down to what they need rather than laying people off at large,” EPMA's Wroe said. In some instances, companies have released workers and even shut down factories.

The PM industries in Italy and Germany, in particular, are “suffering badly,” Wroe noted. Some European regions — including the U.K. and Spain — have been “hit harder than others”, he added, while PM companies in Austria and France have also taken a fall.

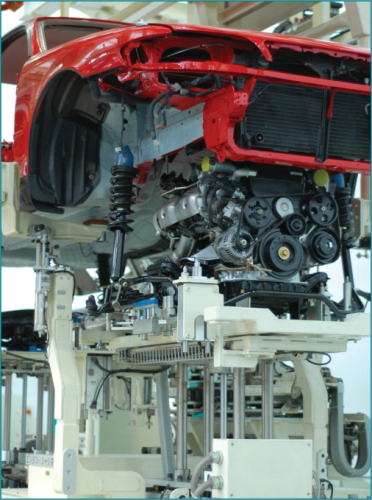

Automotive sector hard-hit

Regardless of geographical location, the automotive sector has been the sole focus for many PM businesses. The proof is in the pudding, as approximately 70% of iron- and steel-based PM parts production goes into light vehicles, according to industry estimates. “Light vehicle production in North America has declined to an estimated annual rate of about eight million units this year,” MPIF's Trombino said. “Coupled with declining sales of SUVs, which are traditionally large users of PM parts (up to 70 lbs), this sharp drop in auto production is hurting PM parts makers and metal powder producers.”

In Europe, most PM companies are linked with the automotive market, where countries have “seen their orders fall by a substantial amount,” EPMA's Wroe said. Components are still being used for new cars, but there's been a projected 25% to 30% decline in vehicle production. “It's obviously very tough,” he added. “It's not just the component makers. It's the powder makers and the raw material and equipment suppliers that are affected as well.”

Some companies are attempting to take matters into their own hands by diversifying their businesses into areas or regions with growth potential. For example, Elnik added lower cost furnaces for iron-based materials to its product offering and is in the process of producing less expensive equipment for the Chinese market. “China is truly a growing market in this industry,” Joens said. “It is being estimated that the 38 MIM parts manufacturers in China will grow to 60 in the next one to two years.”

Germany-based Hocke Gruppe reports that it produces metal-injection-moulded (MIM) parts for multiple markets, such as automotive, medicine, weaponsand hand tools. “As one market is going down, the other is increasing,” reports Frank Weber, head of the MIM department, adding that business from October 2008 to early 2009 was “slightly lower” than the comparable period the previous year. “We are a subcontractor for complex stamping parts, plastic parts, CNC-machining, assembly parts, robotic welding, and we have our own toolmaker shop. So we can offer our customers a wide range of production techniques.”

Indeed, MIM is one of the bright spots of the PM industry. “This specialised technology serves markets such as medical, electronics and firearms, which have not been so severely impacted by the economic downturn,” MPIF's Trombino said. That's allowed some niche products and other areas to experience better business levels, including biomedical supplies, as well as the military and air and space markets.

Following a recent upturn in production and new inquiries last month, Ryer, Inc. (Temecula, U.S.A.) is working on developing several new materials for MIM. “We hope the worst has passed and our business continues to pick back up to where we were in mid-2008 and beyond,” said Ron Peterson, vice president.

Better times ahead?

Indeed, some industry insiders are optimistic that a turnaround will occur later in the year as the global economy slowly mends. Central banks worldwide are working in concert to flood money into the system, which should help free up the credit market, restore confidence and jumpstart the economy. Indications suggest that U.S. auto production and sales could begin to improve in the fourth quarter; CSM Worldwide, Northville, U.S.A., forecasts production levels will rise to 9.9 million vehicles in 2010 and 12.3 million vehicles in 2011.

PM is expected to benefit from this projected growth as MPIF believes the 750 known parts for 300 PM vehicle applications will swell to 1,000 or more once additional uses are identified. “These findings reveal applications that are underserved by PM, leading to potential future automotive applications, hence, the room for growth,” Trombino explained.

In Europe, some industry members say a vehicle-scrapping allowance could stimulate the automotive sector by giving grants to people who trade in an older car for a more ecologically friendly vehicle. “Those manufacturers have seen a big increase in sales the last couple of months,” EPMA's Wroe said. “That's really helped to stabilise the market.”

It's hard to predict what will happen next, but some say the only way to go is up. If the economy improves and the automotive sector follows suit, then it could mean good news for PM companies. “We have hopefully hit bottom, manufacturing-wise, as some industry analysts say, which could signal an improvement in metal powder and PM parts production in the second half of 2009,” Trombino said. “Projected new vehicle production in 2010 and beyond bodes well for a major recovery for our industry.”