Back in the 1950s, William J. Kroll said that it would take only 15 years for his eponymous process to be replaced by electrolysis. In fact, it was not until 1998 that the patent was filed for the Fray-Farthing-Chen (FFC) Cambridge Process, which uses electrolysis to extract metals and alloys from their solid oxides by molten salt electrolysis. At the time the process was considered to have the potential to revolutionise how metals were produced – if it could be commercialised successfully. Since then, however, this commercialisation has made slow process. Now UK-based Metalysis, which owns the global process patents, is on the cusp of commercialising the process for titanium and tantalum extraction. Could this be the breakthrough the industry is looking for – a cheap, single way to produce the metals in large quantities?

A simple process

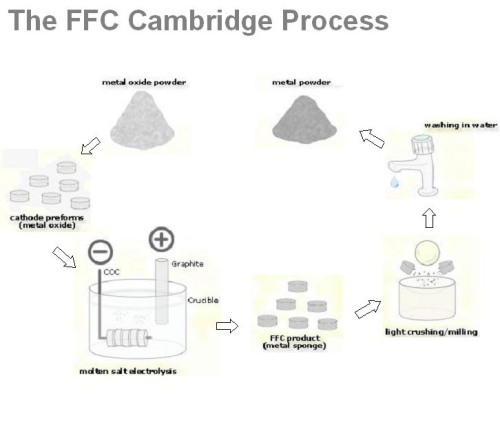

The FFC process was developed by Prof. Derek Fray, Dr. Tom W. Farthing and Dr George Zheng Chen at the University of Cambridge and works by placing a metal oxide in a molten salt bath heated to between 800°C and 1000°C, passing a current between it and a counter electrode. At the interface between the current collector, the salt and the metal oxide, the oxide ions leave the metal oxide and are carried across the salt to the anode, where they evolve as a gas. This leaves the pure metal behind. Metalysis has developed the process further for the production of titanium and tantalum. In this case, the titanium or tantalum dioxide is mixed with water to form a paste, dried and then pushed through an extrusion die to make a honeycomb or tablet. That is then fitted on to a wire, where it forms the cathode in an electrolyte of molten salt. Oxygen separates from the titanium or tantalum and reacts with the anode to produce carbon dioxide and carbon monoxide which bubbles off, leaving the metal. Some of the heat energy is recovered through a heat exchanger, and some of the carbon dioxide is fed back into the process to produce electricity.

This process differs from most electrolytic processes for the production of titanium, in that the titanium always remains the solid phase at the cathode in a sponge state which can be washed and group down to a powder. Tantalum is produced directly in powder form.

“In other processes the metal comes out in a molten state,” says Lee Shaw, technology director at Metalysis. “Processing it any other way in a liquid state is extremely difficult, and makes the whole process more complicated.”

The benefits of the FFC process over older pyrometallurgical technology, such as Kroll, are clear. Because it is a great deal simpler and requires a lower energy input, there are obvious reductions in energy consumed, carbon footprint and cost. According to a 2004 study, the process could generate approximately half the carbon footprint of conventional routes to titanium metal, equating to a saving of 11kg of CO2 per kilogramme of titanium produced (Report on the Potential of the FFC Cambridge Process to Reduce Carbon Impact of the Metals Producing Industries 2004. Prepared by Oakdene Hollins, Metalysis and Tungsten Manufacturing Ltd, with support from the Carbon Trust.). The same report suggests that an integrated 5,000 tonne per year titanium production plant using the Kroll process will require a capital expenditure of £400m or more, while a plant based on the FFC process will cost in the region of £50 million.

It also uses fewer hazardous substances – compare the use of one reagent, a carbon anode, with the chlorine gas, liquid sodium magnesium that conventional technologies have to use.

Metalysis also claims that the metal powders produced by the FFC process could be purer than those produced using conventional technologies, thus reducing the need for post-processing purification steps. “The titanium produced will be purer than titanium sponge from the Kroll process, which is the normal first step in producing titanium,” says CEO Mark Bertolini, who has been with the company for two years.

“Titanium is currently produced using the Kroll process, which operates at is a high temperature, is quite capital intensive and requires the use of hazardous and expensive reagants. Furthermore, Kroll involves a series of complex mechanical and chemical processes before useable titanium is produced. By comparison, the FFC process use a very simple electrolysis, requires less equipment and generates fewer waste products. It’s greener, and cheaper, in comparison,” says Bertolini.

“Kroll plants are expensive. They cost around US$300-500 million. We anticipate that a similar sized FFC plant will cost a quarter, or maybe less, of this to build.” Lee Shaw, technical manager at Metalysis, agrees. “The timescale for construction of such plants is different as well. Building Kroll plants is involves a very long process.”

Metal Powder Report also spoke to Professor George Chen from The University of Nottingham, one of the founders of the FFC Process. He affirms that the process could be a commercial alternative to previous processes such as Kroll. “Traditional processes to produce silicon, titanium and steel all use carbon in their production which obviously increases the problem of pollution. There are also issues with sourcing the coal or charcoal required from non-renewable sources.”

“Traditional methods such as the Kroll process can use up to 50 kW/h of energy to produce 1 kg of titanium. Using the FFC process, 1 kg of titanium can be produced using about half that. In laboratory tests, we’ve managed to get that down to around 20 kW/h.”

Early years

In its early stages, the FFC Process attracted funding from part of the Defence Evaluation and Research Agency (DERA), now called QinetiQ. “QinetiQ spent quite a lot of money and time on the process. In 2005, Metalysis acquired QinetiQ’s FFC business,” says Bertolini. “We got their IP and FFC assets, and they got a minority stake in the business.”

Meantime, other paths of development fell by the wayside. In 2001, a new company, British Titanium plc, was formed to exploit develop the process for titanium based metals. However, it has now gone into liquidation.

At the end of 2001 a second new company, called FFC Limited, was formed to develop the process for the extraction of non-titanium metals. It was renamed Metalysis in 2005.

At this point, the company explored how it could successfully extract a diverse range of metals, including tantalum, silicon, chromium, niobium, zirconium, tungsten and cerium. There were also tests to see if the process could produce various alloys such as TiNi, TiAl3, Ni3Al and TiNb.

In a 2002 Metal Powder Report article (September 2002, pp20-25), the FFC process was mooted as a possible provider of neodymium for low-emission electric cars. But this idea did not come to fruition. “The business has moved on since then,” says Bertolini.”There was some expectation of early electric vehicle sales that hasn’t really transpired. The market wasn’t suitable. We’ve moved on and we’ve done lots of market research to find a better slot for us.”

“At that point, people possibly overstated the capability of the process, assuming that we would be able to scale up its production of a wide range of metals,” admits Bertolini.

Are there any similar or competitive technologies? “There are quite a few universities working on the technology, but none of them are trying to commercialise it yet. There are also a couple of competitive processes, that are slightly different,” he adds.

One of these is the Okabe process, also called EMR/MSE (electronically mediated reduction/molten salt electrolysis), which has been explored by scientists in Japan. It involves two distinct reactions that can be carried out separately. The EMR step connects a titanium dioxide (TiO2) electrode (cathode) with a calcium nickel (CaNi) alloy (anode) in a calcium chloride (CaCl2) melt. Spontaneously, the electrons (current) generated by the dissolution (oxidation) of Ca metal travel through the electrical circuit and reduce the titanium oxide to form titanium metal and calcium oxide (CaO). The MSE step involves connecting the same CaNi alloy electrode (now as cathode) with a carbon electrode (anode) in the same CaCl2 (+CaO) molten electrolyte and applying a voltage. The calcium ions are deposited as Ca metal on the cathode while oxygen (from CaO) will react at the anode to form carbon monoxide/carbon dioxide (CO/CO2).The FFC process occurs at a voltage below the decomposition potential of calcium and there is no calcio-thermic reduction of titanium dioxide. Instead, the reduction process is purely electrochemical without the formation or intervention of Ca metal. The applied voltage causes reduction of the metal oxide cathode and the release of oxide ions into the CaCl2 melt which react at the carbon anode to form carbon monoxide/dioxide. The FFC process, on the other hand, is a one step process and does not require the regeneration of any reductant.

Professor Chen mentions another process. “There are similar electrolytic processes being tested,” he says. “One involves producing titanium from titanium chloride. This process was originally attempted in the 1950s and 1960s but at the time the metal produced was very porous and not of a good quality. Now modifications have been made and it has been suggested that the quality of the metal produced is much better.”

A commercial future

Fast forward to 2009, and during the last five years Metalysis has raised £19 million in venture capital and a £4 million in grants. The company has spent much of the last few years consolidating the Intellectual Property (IP) rights previously held by BHP Billiton, QinetiQ, University of Cambridge and BTi and now exclusively owns and controls the global IP and commercial exploitation rights to the FFC process. This comprises 24 patent families, filed across 88 countries, as well as numerous trade secrets.

The company has also grown – from a workforce of three in 2005, the business now employs 50 people in science and engineering, scale-up and commercial development operations.

The focus of the company has also changed. “We’ve switched from an academic focus to much more industrial focus and we’ve brought in people with more industrial experience. “We’ve also started to engage with the marketplace to properly understand what it needs, both technically and commercially,” Bertolini says. “We spent time looking at what makes sense, looking at how pure we can make the metal. There was a lot of laboratory work, and the focus was on getting the basic operating parameters established. Now we are looking at how we can scale up, and make a few hundred units, then a few thousand units at a time,” he adds. Although the process is suitable for the production of various metals for a range of applications, the company has decided to focus on just two – titanium and tantalum.

We’ve done a big strategic review recently, and that has encouraged us to focus just on a couple of elements. It’s where we’ve got real competitive advantage,” Bertolini says. “The technology can process lots of different elements, but in most cases the current commercial process is already very good – or the difference in price between our raw material and what we could sell the product for isn’t very large.”

“The current process for the production of titanium has lots of steps, lots of capital equipment, and converting it to powder requires extra steps. We’re cutting out a lot of that so I think we’ve got achievable, definite value.” Bertolini, however, doesn’t however rule out commercialising the process for other metals in future. “A lot of the technology we’re developing can be used as a platform technology for some other materials, but the plan is to stick with titanium and tantalum at this stage.”

Tantalum and titanium powders are used increasingly in a diverse range of applications for the aerospace, marine, medical, chemical, automotive and electronics industries. Titanium costs around £8,000/tonne and is therefore one of the more expensive metals. It is as strong as steel but 45% lighter, and is highly corrosion-resistant. Its comparative rarity in everyday life is a result of its stability in its oxide form, which makes production both difficult and expensive. It can be alloyed with iron, aluminium, vanadium, molybdenum, among other elements, to produce strong lightweight alloys.

Tantalum is used predominantly in high-grade capacitors for the electronics industry. For instance, there are 16 tantalum capacitors in an iPhone and typically six in a digital camera.

These are used increasingly by major worldwide industries such as aerospace, marine, medical, chemical, automotive and electronics industries.

Metal powder is the main focus, and at the moment the company is researching how to manufacture different particle sizes. “We’re talking to the marketplace, asking it what it needs in terms of particle size, commercially and technically,” says Bertolini. “Some customers have got technical requirements that are quite low, but need a good price, while others want super-engineered powder at a higher price. Others want volume and a high standard. We are working with powder metallurgy specialists to develop our powders for various technologies, including metal injection moulding, cold isostatic pressing, hot isostatic pressing, laser sintering and electron beam sintering.”

The company is also looking at high value alloys – one of the products mooted when the process was first developed.

Back to the future

Metalysis is now scaling up its technology to enter both titanium and tantalum markets more significantly in 2010. It is projecting modest initial revenues for later this year, with substantially increased sales from 2010 as its semi-continuous pilot plant comes on stream.

The business is already supplying low volumes of metallurgical grade powders, some of which have been used by potential customers in the development of new products. “We’ve provided samples this year to four companies and are in discussions with another four.” These samples have been used in applications including wear resistant materials, capacitors for defibrillators, fabricated products made from tantalum, medical implants, aerospace, components for electrolysis equipment for the Chevy Volt electric car and capacitors for mobile phones. “The defibrillator producer is making a new generation of capacitor and is looking at our material as a new source for that generation of technology,” Bertolini says.

So how does the company plan to develop these relationships? “With tantalum the intention is to develop the technology, build the equipment, manufacture the metal, sell the metal ourselves directly to the marketplace and use that experience to roll out other elements. But because the project volume of produced titanium is higher, we’ve decided that we’ll partner with somebody. So we’re talking to a number of people who have got some complementary skills to build a big plant, to commercialise titanium production in this route.”

The company is patenting a second stage of technology which focuses on technology outside the core process – particularly its commercial side. “We’re looking at how to get the costs down, how to improve productivity and consistency,” says Bertolini. The company filed four patents in 2009 and has got five forthcoming.

This technology will be used in a new semi-continuous pilot plant, which will be commissioned in the spring of 2010. The plant design is capable of producing 50kg of titanium per cell twice daily. It is planned to have production efficiencies of 80% (~300 working days per year) so that each cell is capable of producing 30 tonnes of titanium per year. The design is capable of scaling up by a factor of between 5 and 10, with relatively little additional capital cost. Each cell will require 1.7kg of TiO2 to produce 1kg of titanium (as 40% of TiO2 is oxygen) and each cell will have a footprint of less than 35 square metres with one operator per cell.

The newly developed cells will have high space/time yield (more titanium per cell that can be reduced faster), faster turnaround times between reductions and uniform current densities resulting in reduction throughout the cell, which equates to a consistent product quality. It will also be cheaper and easier to make metal oxide preforms.

In the last few weeks, Metalysis has been named as one of 100 commercial clean technology providers in the Global Cleantech 100, a new list compiled by Cleantech Group and the UK’s Guardian newspaper. It was one of only thirteen firms in the list that are based in the UK and one of very few in the list operating in the materials sector.

Metalysis was placed in the manufacturing/industrial and smart production categories. According to Cleantech, the FFC process “presents the realistic prospect of dramatically reduced costs and improved environmental impacts though the use of sustainable and recyclable materials, such as road salt, and less power and waste.”

The cheap revolution

Metalysis suggests that widespread use of the FFC process will lead to a wider use of titanium, and reduce its cost. “We’re anticipating that the cost of titanium would go down across the board if this process were successful,” Bertolini says. “Powder prices tend to fluctuate according to demand. Several customers have asked us how they can develop a robust supply chain of titanium, to ensure predictability.”

So is the FFC revolution in titanium what the market is looking for? “No technology is a panacea,” admits Bertolini. “But we’re looking carefully at the marketplace to see where the process has really got a competitive advantage. We’re not expecting it to change everything, but we’re expecting to find niches where it could really make a difference.”